Inventory depreciation calculator

Calculator For Total Expense Ratio. We also provide an Opportunity Cost Calculator with downloadable excel template.

Download Depreciation Calculator Excel Template Exceldatapro

Input the current price.

. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021. Separate the cost of land and buildings. At the end of an accounting period the balance on the perpetual inventory account should be the same as the physical inventory available.

An apartment depreciation calculator is used to understand the value of an apartment at a specific point in time after the construction is completed. Sum of the Years Digits Depreciation. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Differences will arise due to accounting errors theft shrinkage etc. You may also look at the following articles to learn more Examples of the Gordon Growth Model Formula. Final value residual value - The expected final market value after the useful life of the asset.

The sum of the years digits SYD depreciation is an accelerated depreciation method that allows you to depreciate less as time goes on much like the written-down value method. Earnings before interest tax depreciation and amortization EBITDA is a measurement that financial analysts use to determine the strength of an organizations operating performance. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase.

If the math seems too complicated you can use a unit depreciation calculator. This electricity cost calculator works out how much electricity a particular electrical appliance will use and how much it will cost. How to Calculate Days Inventory Outstanding DIO On the balance sheet the inventory line item represents the dollar value of the raw materials work-in-progress goods and finished goods of a company.

The distance to travel is divided by the speed and this gives an approximate estimate of the. Prepared as per Schedule-II. You may also look at the following articles to learn more Retained Earnings Formula.

To use a home depreciation calculator correctly you must first identify three fundamental indicators. Apartment depreciation calculator India. D P - A.

Purchases are debited to inventory and sales are credited to inventory with the debit going to the cost of goods sold account. Explanation of Inventory Turnover Ratio Formula. A P 1 - R100 n.

The ratio can show us the number of times and inventory has been sold over a particular period eg 12 months. We calculate inventory turnover by dividing the value of sold goods by the average inventory. The calculator employs three powerful algorithms the Revised Harris-Benedict the Mifflin-St Jeor and the Katch-McArdle equations to calculate your TDEE and BMR.

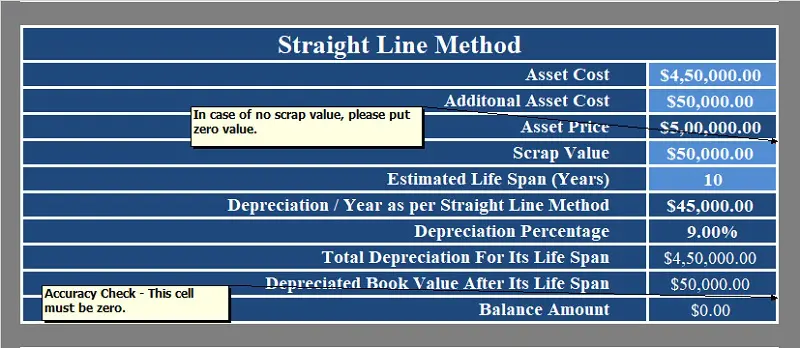

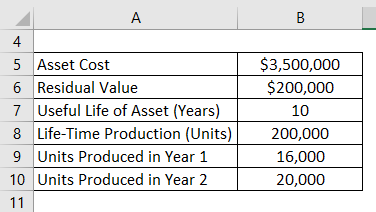

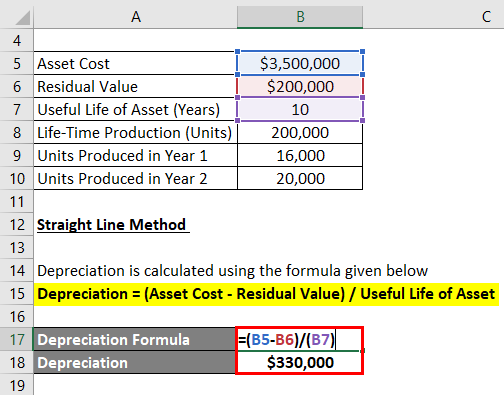

The Car Depreciation Calculator uses the following formulae. We have created a simple and easy Depreciation Calculator with predefined formulas. There are 3 different ways of calculating ending inventory.

Period - The estimated useful life span or life expectancy of an asset. Depreciation rate finder external link Inland Revenue. This has been a guide to Opportunity Cost formula.

In this method items which are purchased first will be sold first and the remaining items will be the latest purchases. FIFO First IN First OUT Method. Formula for Consumer Surplus.

Estimated Time of Arrival ETA The estimated time of arrival is the time at which any cargo airplane ship or vehicle is predicted to reach a given destination eg a bus company will provide an ETA for its journeys based on the average speed expected for a bus over a specific journey. Depreciation methods external link Inland Revenue. Days inventories outstanding 365 1044.

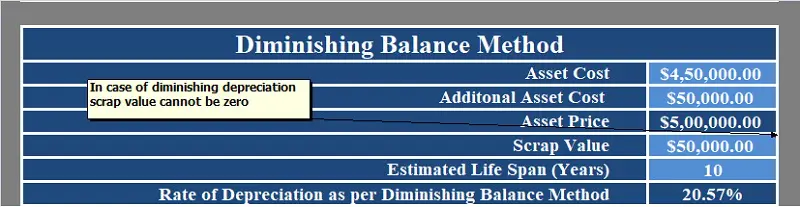

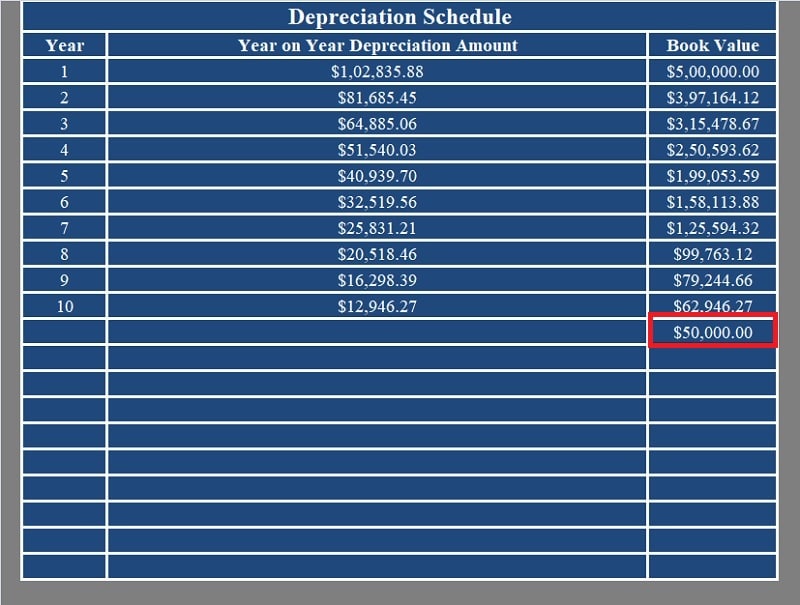

The inventory turnover ratio can be calculated by dividing the cost of goods sold for a particular period by the average inventory for the same period of time. How to use the price elasticity of demand calculator. Hence it is given the name as the diminishing balance method Depreciation Calculator Excel Template.

The average car depreciation rate is 14. Identify the propertys basis. Below is the explanation of the values that are required to add to the calculator for calculation.

We also provide a Mode calculator with a downloadable excel template. ABCAUS Excel Depreciation Calculator FY 2021-22 under Companies act 2013 latest version 0504 download. To calculate an assets adjusted tax value and the amount of depreciation to claim multiply its cost by the.

Price elasticity of demand is a measurement that determines how demand for goods or services may change in response to a change in the prices of those goods or services. Here we discuss How to Calculate Opportunity Cost along with practical examples. Essentially it gives an indication of a companys earnings before it paid any interest and taxes as determined by adding back amortization and depreciation.

Section 179 deduction dollar limits. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000.

Our Total Daily Energy Expenditure TDEE and Basal Metabolic Rate BMR calculator is the perfect tool to help you achieve your workout objectives. How to use this calculator. It calculates the new depreciation based on that lower value.

This calculator is a great way of cutting back on your energy use and saving on your electricity bills. The schedule is presented on an annually. You can use this price elasticity of demand calculator to calculate the price elasticity of demand.

Input what you pay for. The propertys basis the duration of recovery and the method in which you will depreciate the asset. Asset value - The original value of the asset for which you are calculating depreciation.

Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Methods For Calculating Ending Inventory. Periodic straight line depreciation Asset cost - Salvage value Useful life no.

Inventory turnover is a very useful way of seeing how efficient a firm is at converting its inventory into sales. Inland Revenue sets depreciation rates based on the cost and useful life of an asset. This lets us find the most appropriate writer for any type of assignment.

So if the market environment is inflationary ending inventory value will be higher since items which are purchased at a higher. Here is how to use a property depreciation calculator step-by-step. Of periods Moreover this also displays a depreciation schedule which consists in this information.

A comparative benchmarking analysis of a companys inventory turnover and DIO relative to its industry peers provides useful insights into how well inventory is being managed. The value of a built structure decreases due to a. Days inventories outstanding 3496.

Formula to Calculate Capital Asset Pricing Model. Days in Inventory 365 Inventory Turnover Ratio. The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below.

Here we have discussed how to calculate Mode Formula along with practical examples. Just enter a few values and it will automatically calculate depreciation by both the methods. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Depreciation Calculator Definition Formula

Depreciation Formula Examples With Excel Template

Depreciation Calculator

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator With Formula Nerd Counter

Inventory Formula Inventory Calculator Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

How To Calculate Depreciation Using The Reducing Balance Method In Excel Youtube

Download Depreciation Calculator Excel Template Exceldatapro